REFERRAL PERKS®

For a limited time, earn $200* for you and your friend for every successful referral.

For a limited time, earn $200* for you and your friend for every successful referral.

Learn how an FHSA helps you save for your first home faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

Taking advantage of tax-free accounts is a great way to accelerate your savings potential. A First Home Savings Account (FHSA) might be just the right tool to help you on the journey to buying your dream home.

The FHSA is a registered plan designed to help first-time home buyers save for a down payment, tax-free. It combines the very best features of a registered retirement savings plan (RRSP) and tax-free savings account (TFSA).

An FHSA is available to individuals who meet all the following requirements:

![]() Tax-sheltered savings

Tax-sheltered savings

![]() Tax-deductible contributions

Tax-deductible contributions

![]() Transfer to RRSP or RRIF

Transfer to RRSP or RRIF

![]() Combine with Home Buyers' Plan for the same qualifying home

Combine with Home Buyers' Plan for the same qualifying home

![]() Compound growth

Compound growth

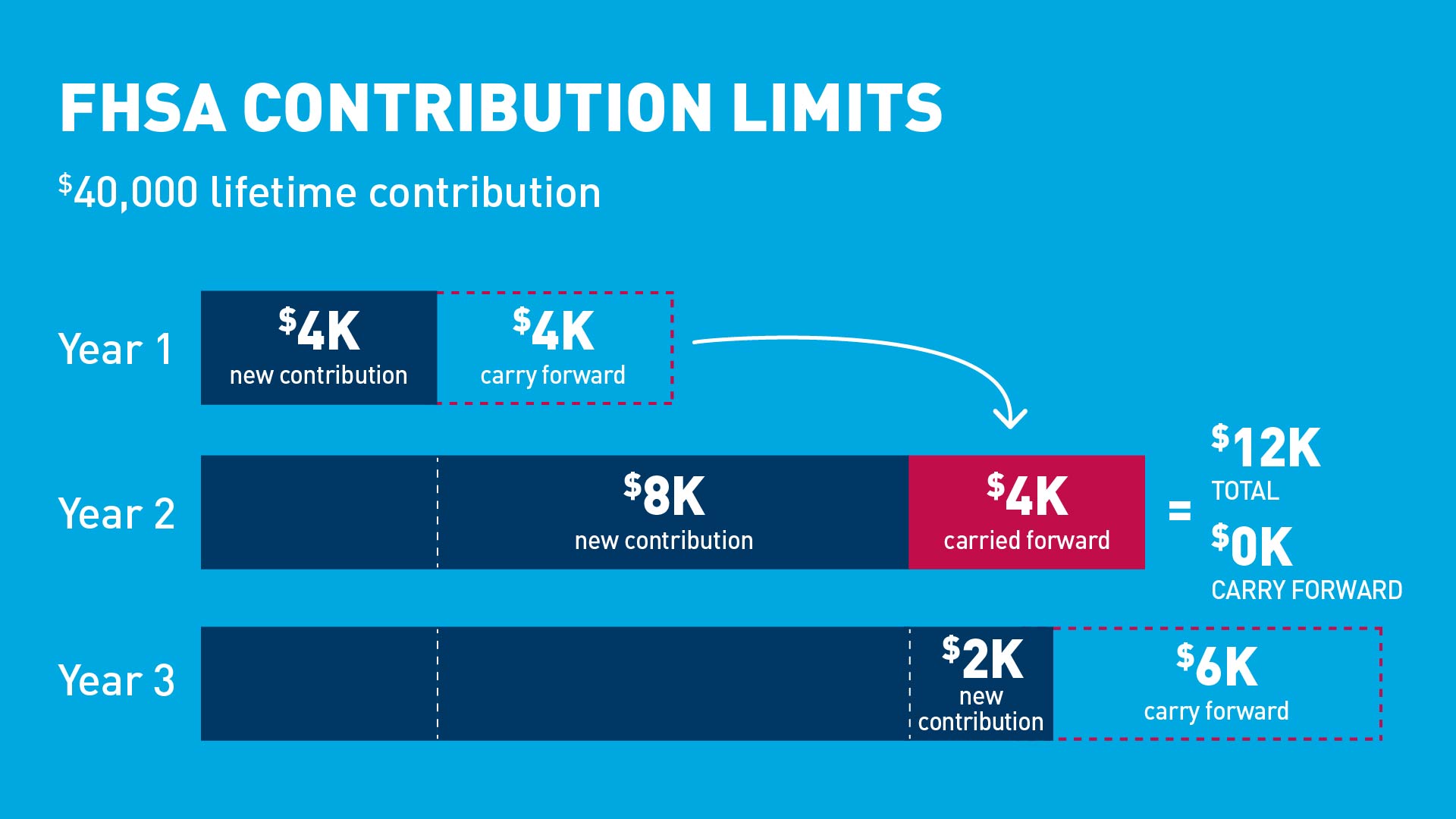

Every year the account holder gains contribution room in the FHSA and unused contributions can be carried forward. It’s important to make sure you don’t over-contribute.

Not sure if this account is right for you?

We can help. Visit a branch or call us at 1-888-597-6083, and let's find the right solution together.

![]()

Tax-Free First Home Savings Account, Explained

Through the new First Home Savings Account, prospective home buyers can build their savings up to $40,000 tax-free for the purchase of their first home. The FHSA is packed with powerful benefits that can help you save faster than ever before.

Mortgage rates are subject to changes without notice and are available on approved credit. Fixed mortgage rates are compounded semi-annually; variable mortgage rates are compounded monthly. Mortgage rates are based on a 25 year amortization. Terms and conditions may apply. Mortgage funds must be advanced within 120 days of the application date. These rates are discounted and cannot be combined with any other rate discounts, promotions or offers. The annual percentage rate (APR) calculation is based on a $300,000 mortgage with a 25-year amortization, for the applicable term, assuming a $300 processing fee. The processing fee includes costs associated with determining the property value and processing the application. If the only cost of borrowing is interest, the APR and interest rate will be the same. This example is for illustrative purposes only. The actual APR may differ depending on your mortgage amount, term, amortization, and applicable fees. Additional fees may apply.

*This mortgage rate is only available to members with greater than 20% down payment, purchasing a residential, owner occupied property valued at under $1,000,000, and who meet other conditions. A premium may be applied to the rates for all other mortgages. Please visit a branch or call us at 1-888-597-6083 for further details.

**This insured mortgage rate is only available to members with less than 20% down payment, purchasing a residential property valued at under $1,500,000, who are eligible for and purchase mortgage default insurance and meet other conditions. Mortgage default loan insurance is required by lenders when homebuyers make a down payment of less than 20% of the purchase price. Mortgage loan insurance helps protect lenders against mortgage default, and enables consumers to purchase homes with a minimum down payment. The premium is calculated based on a percentage of the amount borrowed. Your premium can be paid upfront in a single lump sum payment, or it can be added to the total balance of your mortgage and included in your monthly payments – in this case, interest will apply to the premium as well. The minimum down payment requirement for mortgage default insurance depends on the purchase price of the home. For a purchase price of $500,000 or less, the minimum down payment is 5%. When the purchase price is above $500,000, the minimum down payment is 5% for the first $500,000 and 10% for the remaining portion. Mortgage default insurance is available only for properties with a purchase price or as-improved/renovated value below $1,500,000.

You are a first-time home buyer for the purpose of opening an FHSA if, when you open the account:

AND

Yes, the home you're buying or building must be located in Canada.

Yes, FHSA contributions are generally tax deductible. The maximum lifetime limit is $40,000 and the yearly limit is $8,000 but any unused contribution can be carried forward and contributed in future years. For example, if you contribute only $4,000 in year 1, your contribution limit for the next year is your newly gained $8,000 plus your carry over of $4,000 from the year(s) prior.

No, the only the holder of the FHSA can make a contribution to their FHSA plan.

You have until the end of the year you turn the age of 71 to participate in this program. You should close your FHSA accounts at this point to avoid tax consequences.

You can transfer your FHSA to your RRSP or RRIF's without any tax consequences as long as it is a direct transfer.

Yes, you can transfer from your RRSPs to your FHSA., the transfer will reduce your unused FHSA participation room. You can also transfer from your spousal/ common-law partner RRSPs to your FHSAs.

No, the account is meant for a first time home buyer to save for a down payment and can only be used by the individual holding the plan.

No, the funds in your FHSA are meant to go towards the purchase of a home only.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. Online brokerage services are offered through Qtrade Direct Investing, a division of Aviso Financial Inc.

We acknowledge that we have the privilege of doing business on the traditional territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian