REFERRAL PERKS®

For a limited time, earn $200* for you and your friend for every successful referral.

For a limited time, earn $200* for you and your friend for every successful referral.

Learn how an FHSA helps you save for your first home faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

When you think of your future do you imagine your dream lifestyle? One way to make sure you’re able to afford what your heart desires is by managing your finances today so you’re not still paying off your debts down the road. One of the best ways to level-up your financial know-how is by taking inspiration from others.

To help, we’ve rounded up the six top habits of financially successful people. See how many of them you already do and which ones you want to try.

Do you know what your account balance is right now? You should. One easy way to remember to check your accounts is by pairing it with something else that you do every day – this is called habit stacking. When habit stacking you’re essentially pairing a new habit with something already in your daily routine, making it much more likely to remember to do.

Try this habit-stacking idea: When you log in to start your workday and you’re waiting for systems to load, use this time to check your accounts.

If you don’t already have one, now is the time to put pen to paper (or finger to keyboard) and create a budget. A simple budgeting spreadsheet or a budgeting app can go a long way in helping you track your expenses. Essentially, it’ll outline your sources of income, such as salary and any side hustles, along with your monthly expenses divided into categories like transportation, food, housing, bills and personal items.

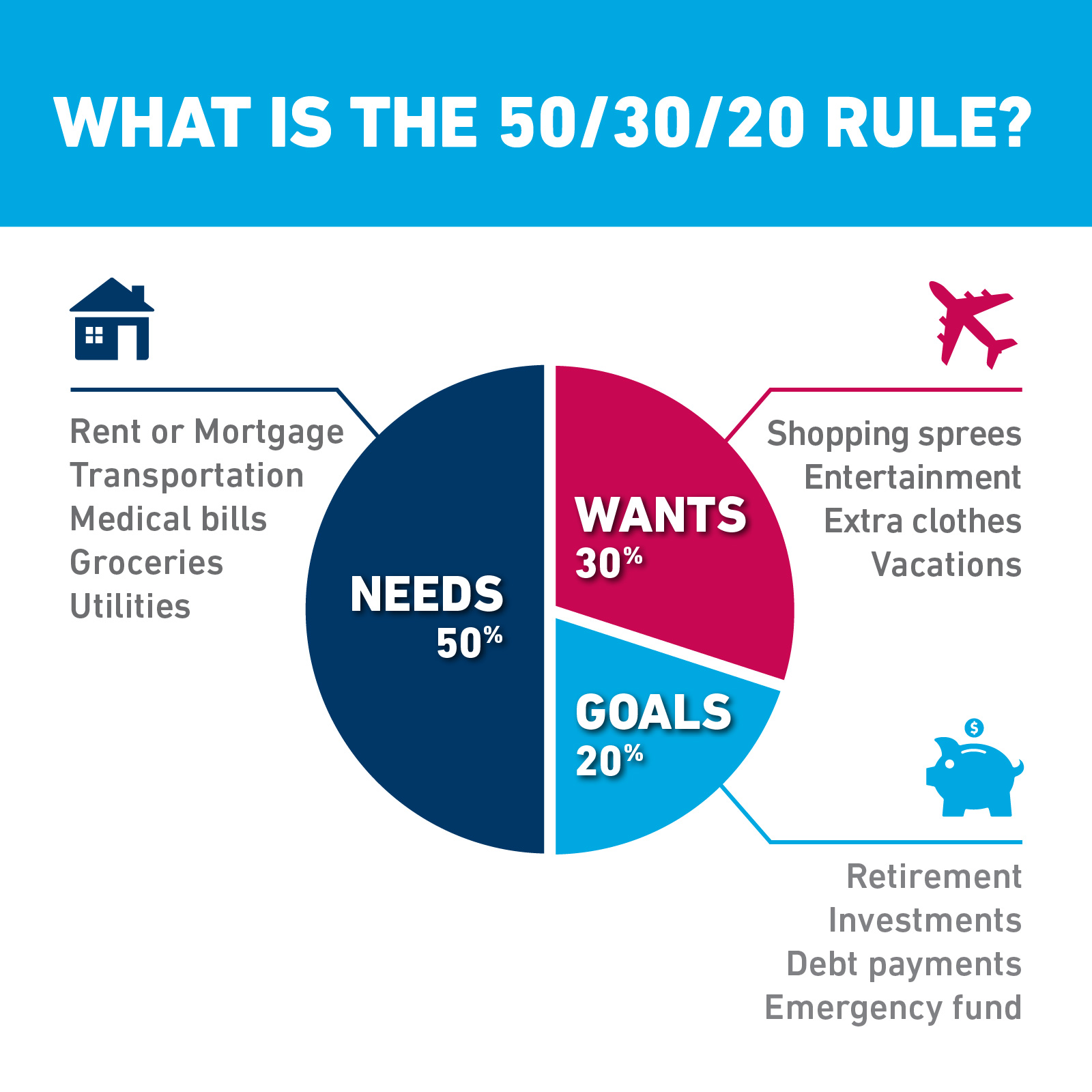

When it comes to budgeting strategies, the 50/30/20 method is highly popular. With it, you’ll allocate 50% of your income for essential purchases (needs), 30% for discretionary spending (wants) or non-essential items (budgeting can still be enjoyable, after all!), and 20% for your savings (financial goals).

Not sure if the 50/30/20 method is right for you? Here are four different budget methods that are equally as successful.

Plenty of people might be shocked at how much they’re overpaying for monthly services they barely use. Don’t let this happen to you. By regularly examining your bank and credit card statements with a fine-tooth comb, you’ll be able to see if you’re paying for something that isn’t necessary. That could be a magazine subscription, streaming service or high-speed internet that you don’t actually need.

Sound too time-consuming? A quick browse through your App Store will reveal an array of tools that can do a lot of the heavy lifting in cutting back on your subscriptions.

Beyond eliminating bills altogether, carve out time to call your phone and internet providers a couple of times each year to see if there are any new promotions that can save you extra cash. Or if your contract is coming up, shop around to see if there are better rates elsewhere.

There are scores of other clever ways to stretch your hard-earned money further. You may consider getting into the habit of making coffee at home, carpooling with a colleague, buying gas on the days it’s cheaper, or stocking up on products when they’re on sale. As you start brainstorming, you’ll quickly discover that the possibilities are endless.

Let’s say you’re dreaming of having that designer purse or pair of running shoes that keep showing up everywhere—and you’ve added it to your shopping cart. Before you hit the check-out button, step back and spend some time reflecting on whether it will add value to your life.

A good rule of thumb is to wait a few hours if the item is less than $100, a few days if it’s more than $100, and a week if it’s a big-ticket purchase that’s over $1,000. If you’ve forgotten about it during that time, you probably didn’t need it to begin with. By taking a more mindful approach to your purchases, you’re more likely to curb impulse buys and spend on the things that bring you joy.

It’s also important to avoid relying on your credit card to cover purchases that fall outside your budget. If something isn’t within your means, try to hold off and save until you can afford it. Because saving gets a whole lot harder when you’re saddled with high-interest debt.

Sure, dining out is fun—but it can really add up. You don’t have to miss out on all the fun, though. Build occasional eating out into your budget but avoid an overly lavish lifestyle that’s filled with fancy restaurants. Instead, set aside time to create a healthy meal plan and a grocery list that you stick to (and that falls within your budget).

This helps prevent impulse decisions at the store and overspending on groceries that end up getting tossed. Other tactics to slim down your food costs are to buy bulk, use sales flyers, purchase generic products over brand names and research budget-friendly recipes.

Another solid financial habit is to transfer money from your chequing account to your savings account right on payday. Whether it’s $20 or $200, small acts like these can make a massive difference when it comes to your financial future.

You could even set up automatic deposits through your financial institution. By doing so, you’ll save a portion of your hard-earned cash, without even having to think about it. You’ll also be less tempted to spend by doing so—since it’s hard to miss something that isn’t there to begin with.

Pro tip: Use online banking to set up automatic deposits into your savings. A good rule of thumb is to allocate 20% of your income to savings.

The good news is: it can. Read on to discover the benefits of a High interest Savings Account and how it can grow hard-earned savings.

We’ve all been there. After a tough day or big win at work, we impulsively act on that urge to get a new pair of jeans or t-shirt. Our moods do, after all, have a major impact on our spending habits. Yet, these purchases can pile up fast. That’s why it’s key to adopt creative strategies to distinguish what you want from what you need.

One way to break the cycle of emotional spending is to text yourself an emoji of how you feel each time you make a purchase. Or consider making a list of your last 10 non-essential purchases. On a scale of one to five, write down the extent to which you regretted it. Are you noticing a lot of buyer’s remorse? That’s OK. The most important thing is to learn from past experiences and keep moving forward.

Speaking of emotion, you can also supercharge your saving goals by nicknaming your account to match its purpose. For example, let’s say you’ve set your sights on an Italian vacation next spring. By naming your account to trigger a positive emotion (like Venice 2024), it can help you reach your goals faster. That’s because you’re less likely to take money out of an account that’s named after something you’re emotionally tied to.

By following these six money-saving habits of financially savvy people, you’ll be empowered to make better decisions and reach your biggest dreams. Keep in mind, managing your money is a life-long journey that will require fine-tuning along the way. So, don’t forget to review your habits on an ongoing basis and change them up if they aren’t working for you. Have questions? Book an appointment and let us help you build a plan to reach your financial goals.

Learn more to save even more!

Use these tools and resources to help you stay on your savings path and maintain your budget:

We acknowledge that we have the privilege of doing business on the traditional territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian