REFERRAL PERKS®

For a limited time, earn $200* for you and your friend for every successful referral.

For a limited time, earn $200* for you and your friend for every successful referral.

Learn how an FHSA helps you save for your first home faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

Whether you're looking to start investing, diversify your portfolio, save for a down payment or just earn more interest than a savings account alone, term deposits can help you achieve your financial goals. They are guaranteed secure investments with very little risk. You set the amount, your financial institution sets the interest rate and you both decide when you get to cash out with your return. The great thing about term deposits is that you can use them for both long-term and short-term needs.

This article is designed to give you an overview of term deposits and some ideas of how you might incorporate them into your financial plan. Let's explore:

A term deposit is a cash investment with a guaranteed return and generally offered at a fixed interest rate over a set period (the term). You’ll also encounter the term Guaranteed Investment Certificates (GICs), which are basically the same thing as term deposits.

Depending on the type of term deposit you purchase, interest can be paid to you annually, at the end of the term or sometimes even monthly.

Understanding whether your term deposit is redeemable, non-redeemable or fully cashable is essential based on your goals. If you’re parking your rainy-day fund in term deposits, you'll want them to be liquid (readily available), so you can access your money in case of an emergency.

If you're using them to save for a purchase you know is five years away, you can keep your money working for you by locking it into a longer-term deposit with a higher rate. Often, this long-term strategy can be used to “purchase an income” in retirement for yourself or a family member.

In buying a term deposit, you also get the option to have the interest compound, or to pay out monthly, quarterly, semi-annually, or annually. This can be a great way to help boost your income, especially if it’s limited already.

Redeemable term deposits

A redeemable deposit means you don’t have to wait until the end of the term to take out your money. Make sure you pay attention to the conditions surrounding redeemable term deposits. For instance:

There are other possible conditions, so if you anticipate that you might need to access your money, ask your financial advisor before you purchase a redeemable term deposit.

Some term deposits are completely cashable, meaning that at any point during the term you can redeem them with no fees or penalties, along with whatever interest you've earned. Because of their flexibility, redeemable term deposits will tend to have lower interest rates than non-redeemable term deposits.

Here are some examples of redeemable term deposits we offer:

Non-redeemable term deposits

On the other hand, a non-redeemable deposit means your money is locked in for a fixed period. This is a better option for your longer-term goals where you want to store money away and not touch it for the entirety of the term. This way, you could possibly get a potentially even higher return.

Except for prime-linked and market-linked terms, term deposits aren't negatively affected by the market. Even with those types of terms, your potential maximum return may be impacted, but your initial investment is protected.

Even if the interest rate on the term you deposited changes prior to maturity – something that can happen at any time – you will earn the original rate you got on the day you made your deposits. The exception to this is if you have a term deposit with a variable rate, in which case you're hoping the interest rates go up more than they go down over the course of the term. That's why term deposits are considered secure, conservative, short to medium-length investments and a great way to diversify your portfolio.

Term deposits will generally give you a better rate of return than a savings account and a much better rate than a chequing account. If you're parking money for an emergency fund or for a vacation in the next couple of years, a term deposit is a great option.

The market boasts the possibility of higher returns, but not without risk. Any investment you make, whether in stocks*, bonds*, mutual funds*, ETFs*, and so on, will ride both the ups and the downs of the market. The greater the potential return, the greater the risk. So, the market may not be the best place to grow your money in the short term.

With most term deposits, your rate is locked, and your returns are guaranteed. If you're saving for a down payment in the next five years, a term deposit is a great tool. View our current term deposit offers here — $500 is all it takes to get you started and there are no maximum deposit limits.

The rule of investing is generally the safer the investment, the lower the return (also the shorter time in market, the lower the return). With the safety of a term deposit, you sacrifice higher potential rates of return, but your money is generally safer.

When you compare a term deposit to a High Interest Savings Account, a term deposit tends to have higher rates, but the savings account gives effortless access to funds. With the term deposit, you're also locked into the rate you got when you made your deposit (with the exceptions already mentioned above), while the interest rate on your savings account can change at any time.

Remember that term deposits are taxed at a higher marginal tax rate, so you can use available tax shelters like your RRSP, TFSA, RRIF, RESP or RDSP. Not all term deposits are available with every registered plan, so check with your advisor.

Related reading: Complete guide to TFSAs

As we saw when comparing term deposits to savings accounts, one of the places savings accounts tend to have an edge is with liquidity (having easy access to the money in the account). Experienced investors overcome this issue by laddering their term deposits.

How to ladder your investments

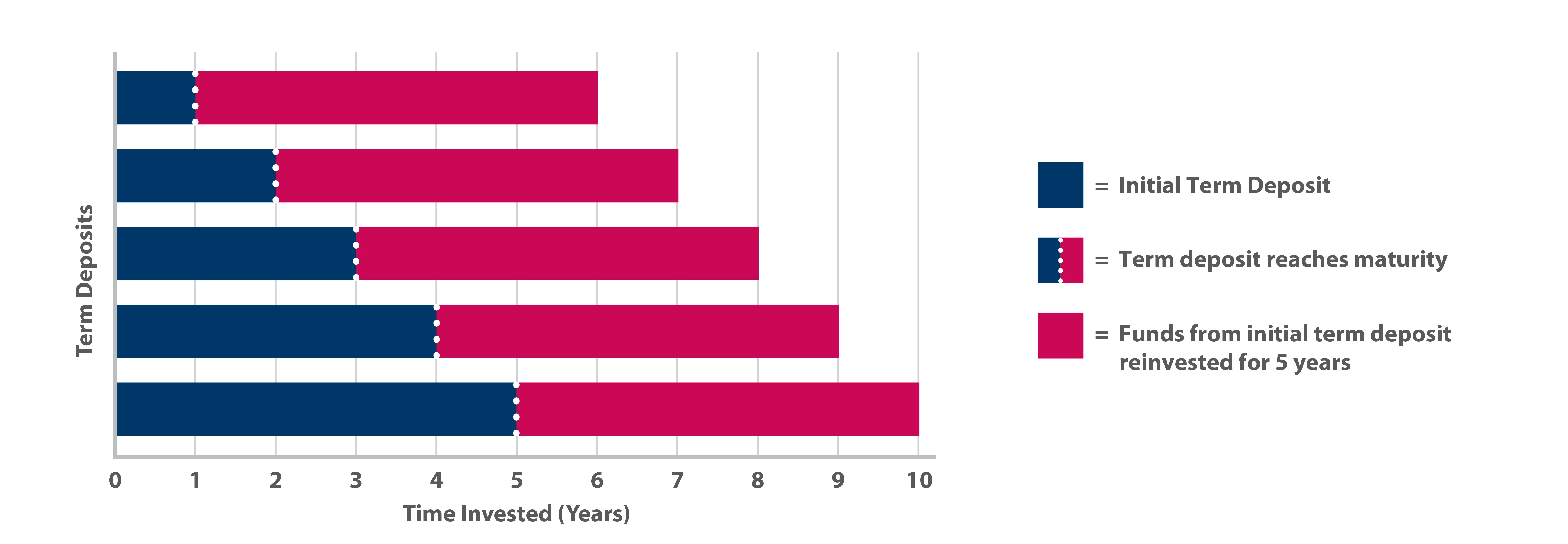

Laddering strategies improve liquidity by providing access to your funds at regular intervals. It works by dividing your capital into five equal portions and investing in terms of maturity dates ranging from 1 - 5 years, like the rungs on a ladder.

Each year, one of your terms will mature and grant you access to your savings. This allows you to decide whether to re-invest your funds in another five-year term or deposit them into a savings account based on your current situation. In addition, laddering strategies reduce the risk of investing in a low-interest-rate environment since multiple investment opportunities offer different interest rates.

The great thing about term deposits is that you can customize your terms as you like.

Short-term vs. long-term deposits

Depending on your financial plan, you can invest in a term deposit with terms ranging from one month to five years. Short-term deposits will tend to have lower interest rates than longer terms. You can use shorter terms (i.e. terms under one year) to your advantage and ladder your investments to always have access to some liquid cash – more on that later.

Prime-linked term deposits

You can get a prime-linked term deposit, where the interest rate is not fixed but changes along with the prime rate. This gives investors a great opportunity to lock their money in while taking advantage of the interest rate environment. If the prime rate goes up, so does the rate on your deposit.

A prime-linked term deposit, like the three-year PRIMECONNECT®, is generally influenced by changes to the Bank of Canada’s prime rate to take advantage of forecasted overnight rate hikes. It allows you high rates and the flexibility to redeem once a year (on its anniversary), while earning even more if the prime rate increases. It is available in non-registered and registered accounts, including Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSP).

Term deposits, especially those linked to the prime rate when interest rates are expected to rise, are low risk investments that can help you reach your short-term goals but will also complement your long-term investment plans.

Market-linked guaranteed investment certificates

Another popular form of term deposit is a market-linked guaranteed investment certificate (or market-linked GICs, for short). These are tied to a defined basket of securities that historically have performed well. They often protect the investor’s principal investment and offer a minimum guaranteed return with the potential for significantly greater returns (up to a maximum) based on the performance of the market.

Think of it as having a stable floor, and potentially a high ceiling. Market-linked Guaranteed Investment Certificates (GICs) often center around a specific theme, such as targeting a particular sector, focusing on domestic or international markets, or companies committing to sustainable and responsible investment practices. Let’s explore that a little more.

Responsible Investing and Term Deposits

Responsible investing incorporates environmental, social and governance (ESG) factors into your term deposit strategy.

These products invest in stocks and bonds with brands that value:

Also, these companies are regularly assessed by fund managers and represent your best interests.

Learn more about responsible investing and market-linked GICs.

Our financial advisors have the expertise and experience to help you create a financial plan that’s based on your personal circumstances and that helps you reach your personal financial goals. Take the first step towards understanding your financial picture.

Planning for the future?

Let us help. Our advisors will work with you to help you reach your goals with a personalized plan.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc.

We acknowledge that we have the privilege of doing business on the traditional territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian